Assignment 2, problem 2

Contents

Problem 2(a): European Put Option

S0 = 10; u = 1.1; d = 0.9; % binomial stock price model rho = .01; % interest rate per period N = 12; % maturity K = 11; % strike [V0_EP,av] = xbinom_eu_put(rho,S0,u,d,N,K,5); disp(' S0 V0_EP') disp([S0*av',V0_EP']) % table: initial stock price, option price

S0 V0_EP

3.6665 6.0958

4.4813 5.2862

5.4771 4.3248

6.6942 3.2494

8.1818 2.1704

10.0000 1.2439

12.2222 0.5896

14.9383 0.2222

18.2579 0.0634

22.3152 0.0128

27.2741 0.0016

Problem 2(b): European Call Option

[V0_EC,av] = xbinom_eu_call(rho,S0,u,d,N,K,5); disp(' S0 V0_EC') disp([S0*av',V0_EC']) % table: initial stock price, option price

S0 V0_EC

3.6665 0.0003

4.4813 0.0055

5.4771 0.0399

6.6942 0.1817

8.1818 0.5903

10.0000 1.4820

12.2222 3.0499

14.9383 5.3985

18.2579 8.5594

22.3152 12.5661

27.2741 17.5138

Problem 2(c): American Put Option

We see that the American Put option price is larger than the European Put option price. In the graphs the black dotted curve is the European Put price.

[V0_AP,av] = xbinom_am_put(rho,S0,u,d,N,K,5); disp(' S0 V0_AP V0_EP') disp([S0*av',V0_AP',V0_EP']) % table: initial stock price, option price figure(1); hold on plot(S0*av,V0_EP,'k:'); hold off; legend('option price','current payoff','current payoff with discounted strike','European Put price') figure(2); hold on plot(K./av,V0_EP./av,'k:'); hold off; legend('option price','current payoff','current payoff with discounted strike','European Put price','Location','best')

S0 V0_AP V0_EP

3.6665 7.3335 6.0958

4.4813 6.5187 5.2862

5.4771 5.5229 4.3248

6.6942 4.3058 3.2494

8.1818 2.8182 2.1704

10.0000 1.4895 1.2439

12.2222 0.6668 0.5896

14.9383 0.2415 0.2222

18.2579 0.0669 0.0634

22.3152 0.0132 0.0128

27.2741 0.0016 0.0016

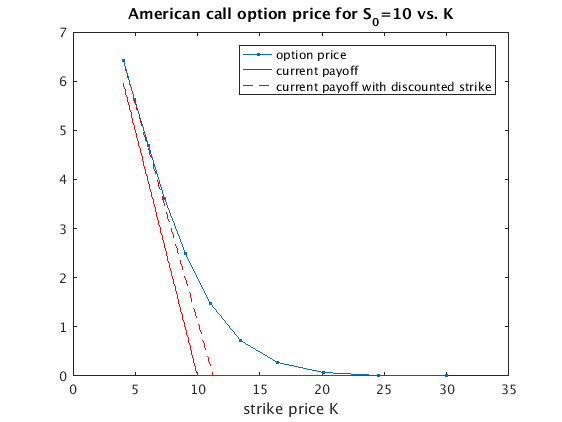

Problem 2(d): American Call Option

We see that the American Call option price is the same as the European Call option price.

[V0_AC,av] = xbinom_am_call(rho,S0,u,d,N,K,5); disp(' S0 V0_AC V0_EC') disp([S0*av',V0_AC',V0_EC']) % table: initial stock price, option price

S0 V0_AC V0_EC

3.6665 0.0003 0.0003

4.4813 0.0055 0.0055

5.4771 0.0399 0.0399

6.6942 0.1817 0.1817

8.1818 0.5903 0.5903

10.0000 1.4820 1.4820

12.2222 3.0499 3.0499

14.9383 5.3985 5.3985

18.2579 8.5594 8.5594

22.3152 12.5661 12.5661

27.2741 17.5138 17.5138